The Liquidity Trap: Why Your $200M Endowment Can’t Invest Like Yale and Harvard

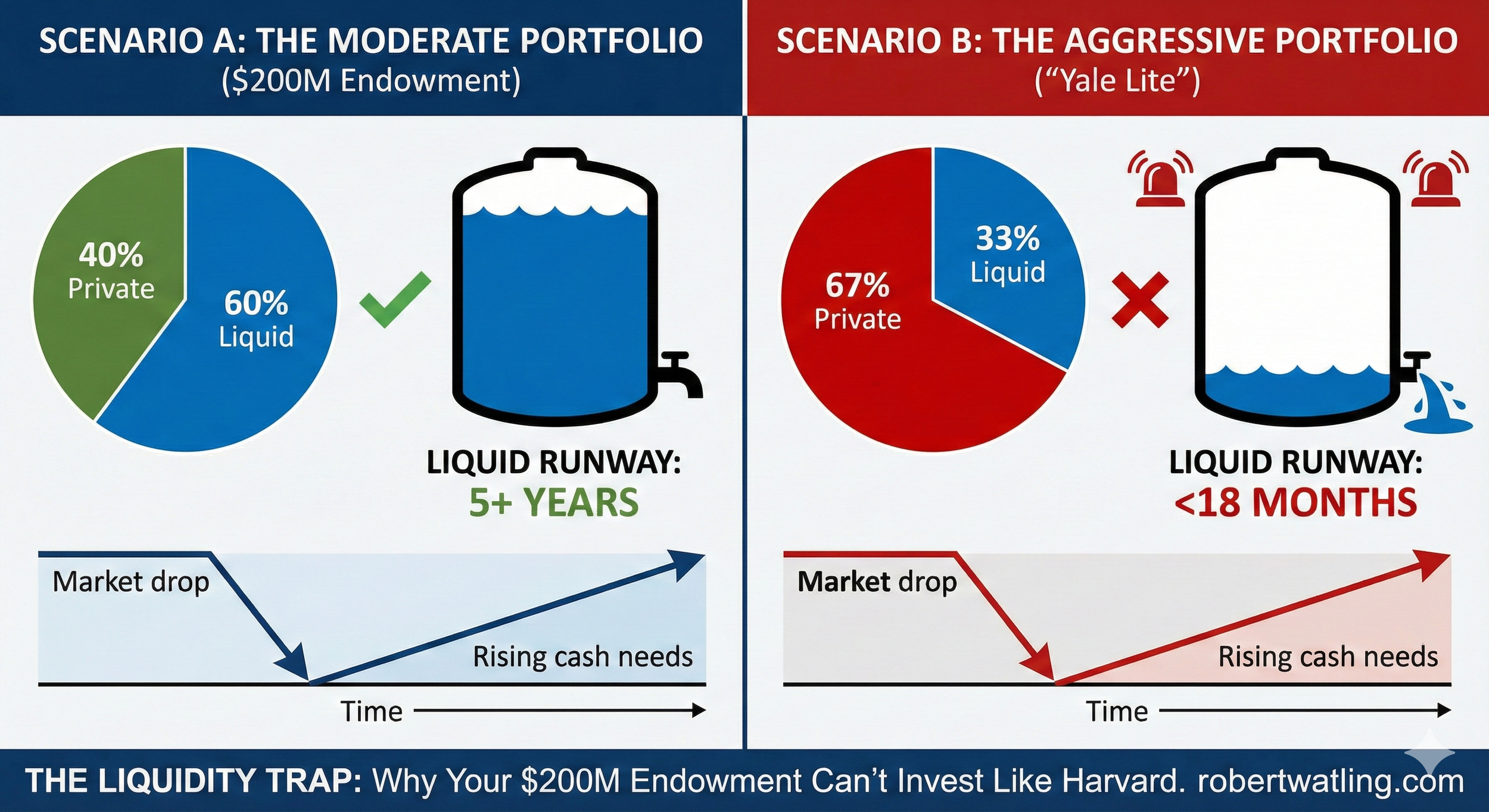

The "Yale Model" of high allocations to illiquid private investments works for elite endowments but creates a dangerous trap for mid-sized, tuition-dependent universities. This post analyzes the structural risks when a $200 million endowment mimics a $50 billion strategy without the requisite balance sheet. Through a hypothetical stress test, we demonstrate how a "perfect storm" of market declines, stopped distributions, and spiking capital calls can drain a university’s liquid assets in under 18 months. We argue that liquidity must be viewed as a strategic asset class and provide a framework for stress-testing your portfolio against existential risk.